The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

National Beverage Corp (NASDAQ:FIZZ)

- On Sept. 11, National Beverage posted weaker-than-expected quarterly sales. “Our solid operating performance amid the challenging global environment, marked by uncertainty in consumer spending and geopolitical events, reflects the strength of our brands and the success of Team National’s management strategy. We continue to generate exceptional operating cash flows while maintaining one of the strongest balance sheets among our beverage peers,” as stated by a company spokesperson. The company’s stock fell around 10% over the past month and has a 52-week low of $36.27.

- RSI Value: 28.6

- FIZZ Price Action: Shares of National Beverage gained 0.1% to close at $36.92 on Tuesday.

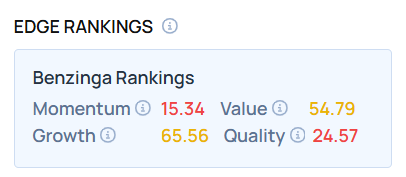

- Edge Stock Ratings: 15.34 Momentum score with Value at 54.79.

Sprouts Farmers Market Inc (NASDAQ:SFM)

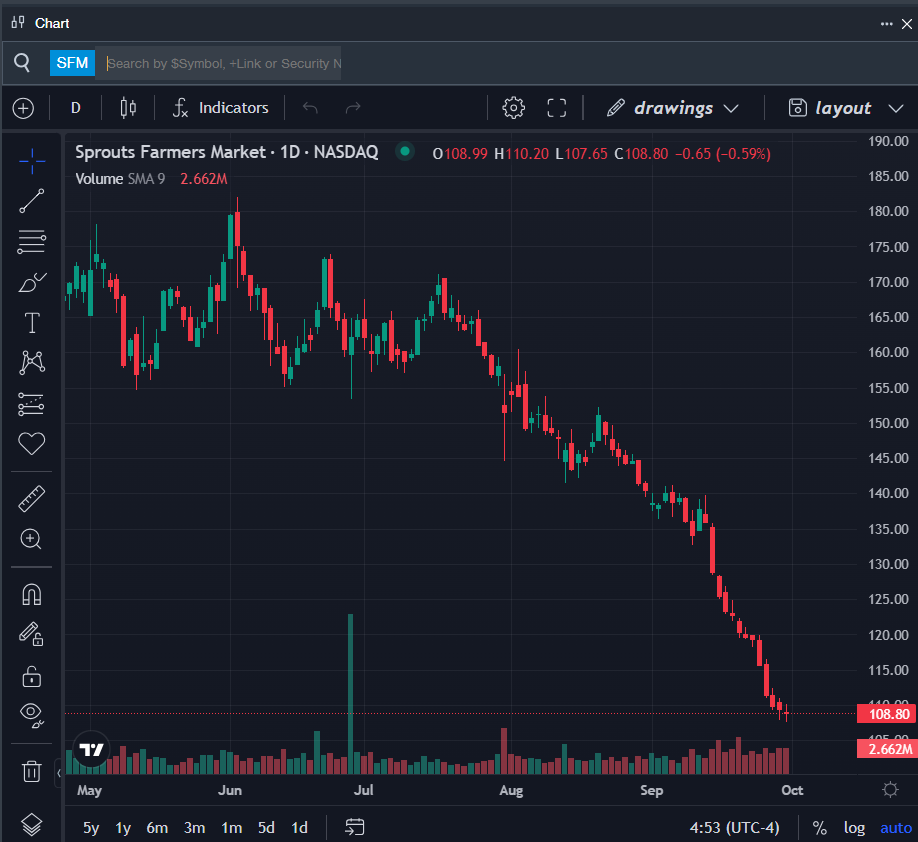

- On Aug. 19, Sprouts Farmers Market announced a $1 billion share repurchase authorization. The company’s stock fell around 22% over the past month and has a 52-week low of $107.65.

- RSI Value: 13.6

- SFM Price Action: Shares of Sprouts Farmers Market fell 0.6% to close at $108.80 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in SFM stock.

J&J Snack Foods Corp (NASDAQ:JJSF)

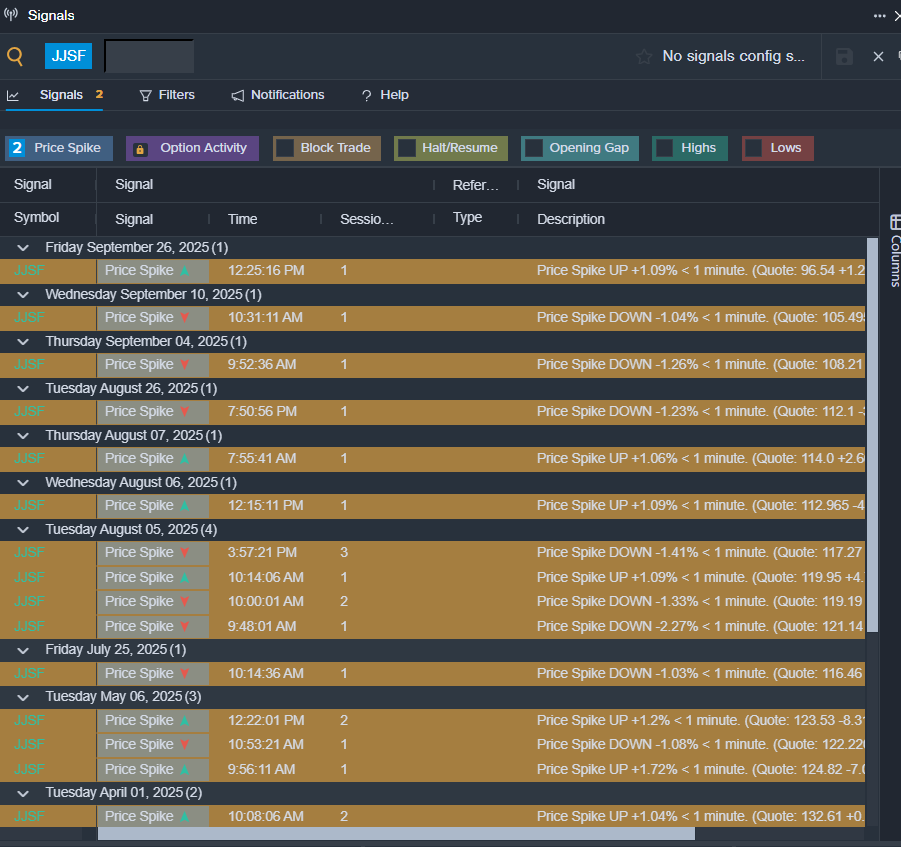

- On Aug. 5, J&J Snack Foods posted upbeat quarterly earnings. Dan Fachner, J&J Snack Foods Chairman, President, and CEO said, “We delivered strong third quarter results, achieving record performance across key financial metrics, including net sales of $454.3 million and adjusted EBITDA of $72.0 million. These results reflect the resilience of our business, the strength of our diversified portfolio, the continued appeal of our brands, and our team’s relentless focus on disciplined execution in the face of a cautious consumer environment and weather-related headwinds.” The company’s stock fell around 12% over the past month and has a 52-week low of $94.13.

- RSI Value: 28.4

- JJSF Price Action: Shares of J&J Snack Foods rose 0.2% to close at $96.09 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in JJSF shares.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Read This Next:

Photo via Shutterstock